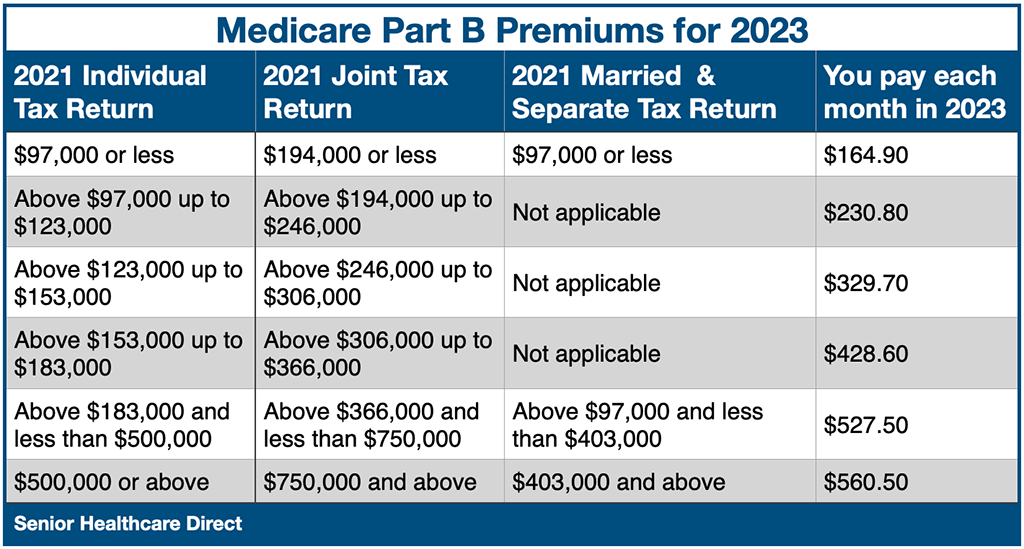

2025 Medicare Deductible Rates By State - The medicare part b premium, deductible, and coinsurance rates are. What Is 2025 Medicare Part B Deductible Image to u, The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023. About 8% of medicare part b beneficiaries are subject irmaas, according to the centers for.

The medicare part b premium, deductible, and coinsurance rates are.

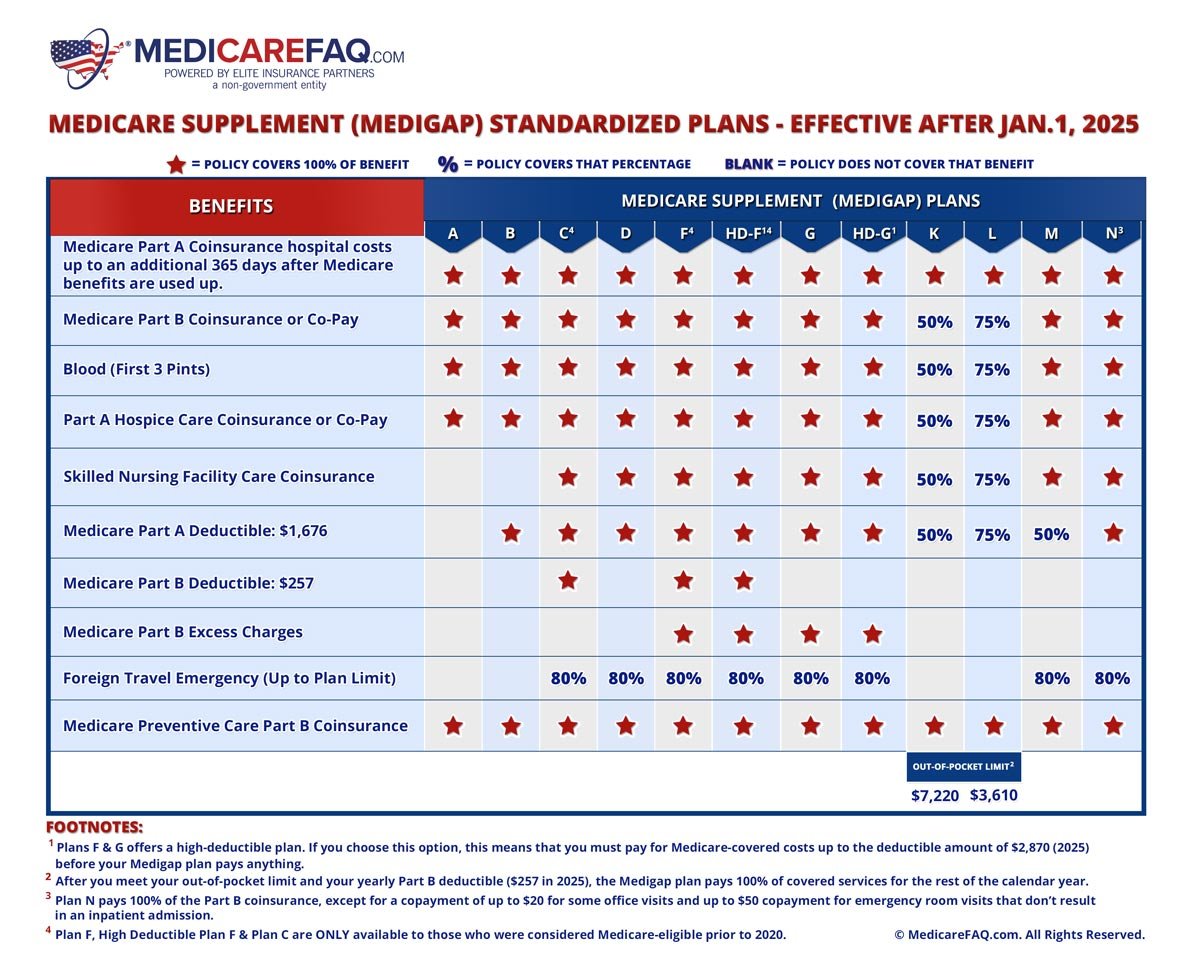

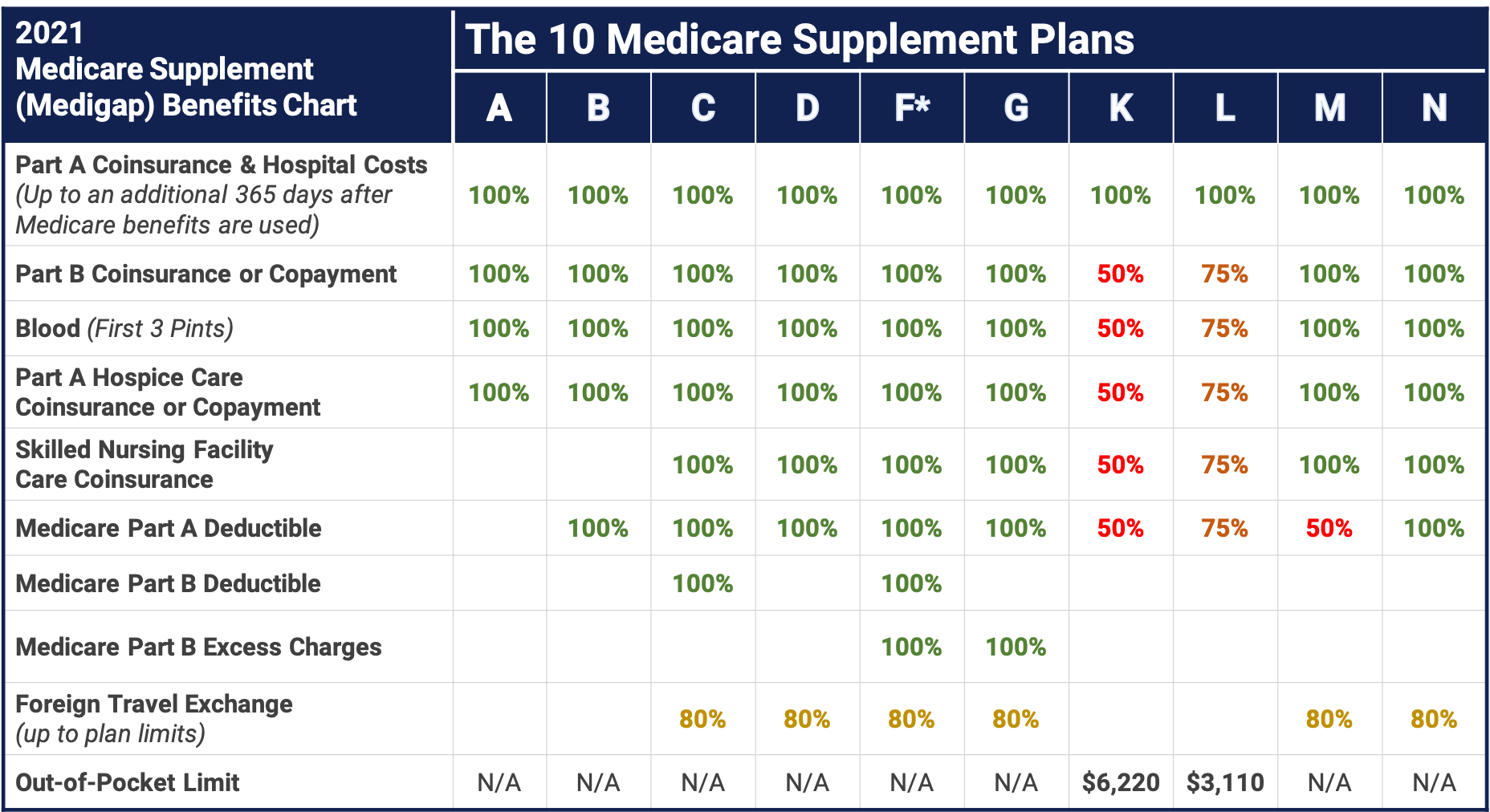

Medicare Part G Deductible 2025 Sib Lethia, Here are the medicare premiums, deductibles, and copay amounts for 2025. The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023.

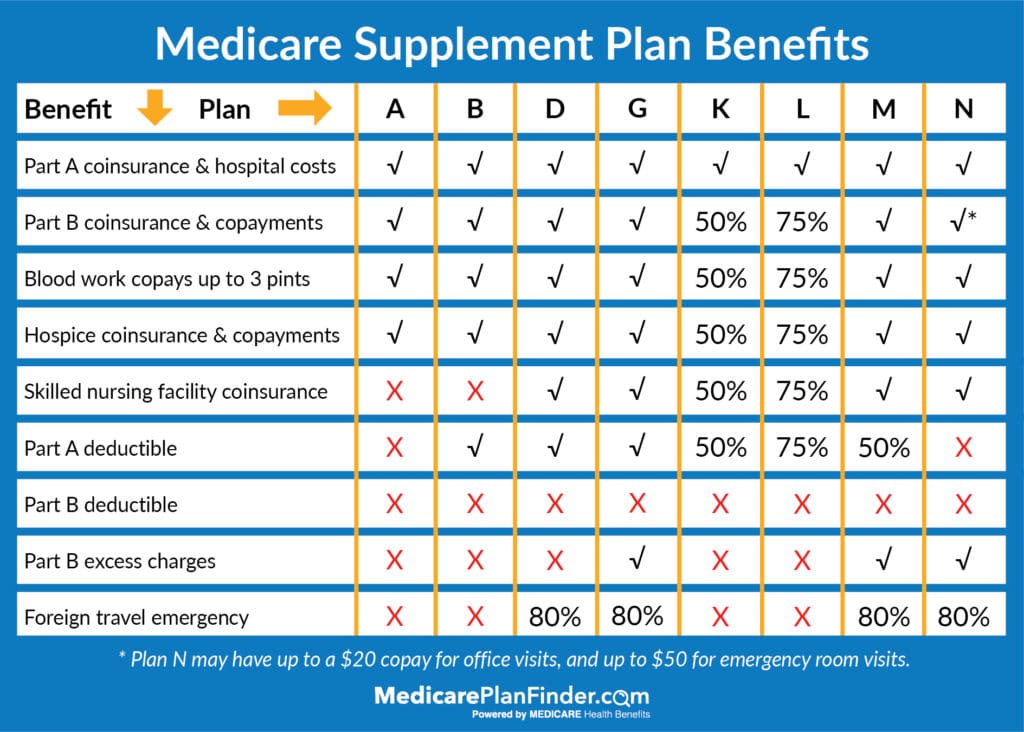

2025 Medicare Tax Rates And Limits Flori Jillane, After your deductible is met, you typically have to pay a 20% coinsurance of the medicare. An official website of the united states government.

Read about premiums and deductibles, income limits, coverages and more. The 2025 part b deductible is $240 per year.

2025 Medicare Deductibles & Copays — Telos Actuarial, The medicare part b premium, deductible, and coinsurance rates are. The cost of medicare part a deductible, part b and part d are all rising.

Medicare Advantage Plans Indiana 2025 Rakel Caroline, Here's what you need to know. What are the changes to medicare in 2025?

What Is The Medicare Supplement Plan G Deductible For 2025 Wendi Josselyn, The annual deductible for all. Today, the centers for medicare & medicaid services (cms) released the announcement of calendar year (cy) 2025 medicare advantage (ma) capitation.

The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2023.

Medicare Part A Deductible For 2025 Gabbey Arliene, Here's what you need to know. For medicare part b, the standard monthly premium has risen to $174.70 for 2025, marking a rise of $9.80 from $164.90 in 2023.

2025 Medicare Deductible Rates By State. The annual deductible for all part b enrollees will be $240 in 2025, increasing from $226 in 2023. If you have medicare part b and/or medicare part d prescription drug coverage, you could owe a monthly surcharge based on an income related monthly.

The average medicare advantage plan medical deductible is $25.44 per year.